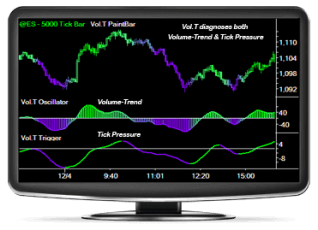

Getting the best swing trading measure can be very complicated at times. Technical trading with indicators is easy, and many traders around the world are willing to earn money day by day, due to the knowledge that trading indicators provide those with the expertise to use them. If you are just starting out, the challenge is that there are a lot of TradeStation Indicator available. This makes it incredibly difficult to determine which measure to use.

This is where new traders need some support in realizing that all metrics are working. The trick to choosing the best trading indicator is not to find the correct indicator, but to find the right indicator for you and your trading style.

Any of the most common trading indicators can be used for trading purposes. We are going to work on every business and any timeline, even though you do not swing the trade. Instead of looking for the right indicator, ask yourself what type of trading you want and what you want or need from your indicator. Indicators also represent different business facets.

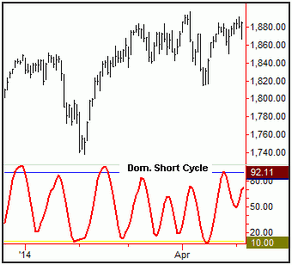

Some are guiding and alert about potential areas where the stock may be over-purchased or over-sold. Any metrics are moving average depending on the trend and, then, map the market price on the line. If you know what you need from an indicator, you will identify and start playing with indicators of this kind. This should make it much quicker and faster to find the best predictor for your trading style.

When checking and playing with trading metrics, bear in mind that no predictor is flawless. If used correctly, an indicator will give you a trading advantage. Many new traders believe that the more metrics you put on your map, the better the trader you will be. It could not have been any farther from the facts. It is advised that you use a maximum of 3 metrics at one time.

If you continue using more than that, you will find that your maps are cluttered and that trading decisions may become more difficult. It is normal for one predictor to clash with another marker that you are using at the same time. In this case, what trading signal are you following? Keep this simple. Never use more than three metrics at a time.

There are a number of trade and swing market metrics available.

Getting the correct or best trading indicator may not be straightforward, but you can ease the process by first choosing the type or amount of details you want your technical indicator to tell you. Will you want to know when the demand may be tired and able to step back? Alternatively, do you want to use shifting demand averages? If you know what you want, it will be easy to try and play with indicators of this sort before you find the one that fits your style. Bear in mind, however, that this is not necessarily greater. Hold your trading markers to a minimum on your map. Having more than 3 will potentially make trading more difficult, and this is something that no trader would like.